What does Asymmetric mean (in investing)?

Asymmetric returns refer to investment opportunities where

the potential upside is much greater than the potential downside.

Asymmetric deals offer a risk-controlled path to potentially outsized returns —

ideal for investors who want to protect capital while aiming high.

Apply To Join Zenya Capital’s Investment Club

The Zenya Capital Investment Club is an exclusive, private group of accredited and qualified investors who are looking to passively grow their capital, diversify their portfolio, and share in powerful tax advantages through a strategic multifamily real estate Fund of Funds (FoF) or multiple syndication structures and real estate syndications.

Our members gain priority access to handpicked, high-quality, asymmetric real estate opportunities — deals designed to minimize downside risk while offering outsized potential returns. These investments are typically backed by cash-flowing multifamily assets in strong markets, managed by experienced operators with a track record of success.

Whether you’re a seasoned investor or just beginning your journey toward building generational wealth, Zenya Capital’s Investment Club provides the access, education, and opportunities you need — all without the stress of active property management.

Key Benefits:

1. Passive income & appreciation

2. Direct ownership in institutional-grade assets

3. Tax-deferred growth through depreciation and cost segregation

4. Professionally vetted deals & operators

5. Strategic access to Fund of Funds and syndication structures

6. Asymmetric risk-return profiles (low downside, high upside)

You’ll Get Access To

Exclusive Investment Opportunities

Gain priority access to carefully vetted, often off-market multifamily real estate investments through our strategic Fund of Funds—built for passive investors seeking diversified exposure, asymmetric returns, and long-term wealth creation.

Private Investor Webinars

Join exclusive, members-only real estate investor webinars where we review live deals, share current market insights, discuss passive income strategies, and host expert Q&A sessions so you stay informed and confident in your investment decisions.

Priority Invitations

Receive early access to new real estate investment opportunities, private investor calls, and limited-allocation offerings before they are released to the public.

Ongoing Support & Insights

We build long-term investor relationships through consistent communication, including performance updates, quarterly reports, market research, and ongoing real estate education.

And Much More…

From tax-advantaged investing education and capital stack breakdowns to direct investor support, our investor club provides a streamlined path to diversified passive income and long-term wealth building through real estate.

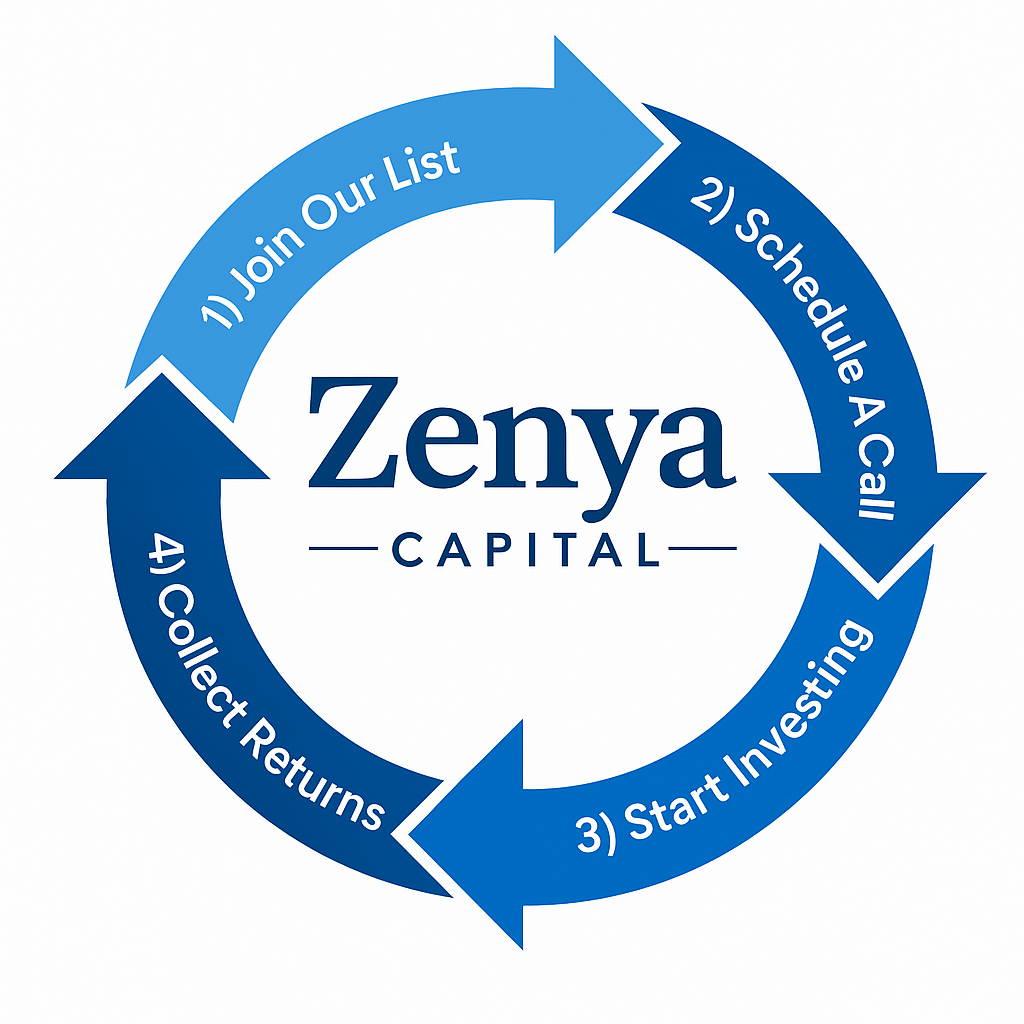

The Hands-off Multifamily Investing Process

Step 1: Join Our List

Fill out some basic information on our form which will get you access to dive into our educational resources.

Step 2: Schedule A Call

Set up a brief introductory call with our team so we can learn more about your investing goals and answer any questions you may have.

Step 3: Start Investing

Once we have a new multifamily deal, we’ll share this exclusive investment opportunity with you. If you elect to invest, we’ll walk you through the whole funding process.

Step 4: Collect Returns & Start Building Wealth

Start collecting cash distributions every month/quarter while receiving ongoing reporting and updates.

Benefits of investing in real estate

Together, we get cash flow, appreciation,

amortization, and depreciation.

How Our Investors Build Wealth

My New Book Is Coming Soon

What is a Special Purpose Vehicle (SPV)

in the context of a Fund of Funds (FoF).

The Main Real Estate Deal Strategies

Understanding the Different Types of Investment Funds

1. Venture Capital (VC) Funds

VC funds invest in early-stage or high-growth startups. Investors gain equity in exchange for capital, with high risk and potentially high returns. These are not typically backed by hard assets and are more speculative.

2. Private Equity Funds

Private equity funds buy and improve private companies, aiming to sell them for a profit. These funds often have long hold periods and target operational improvements, but they generally require larger commitments and longer lock-ups.

3. Debt Funds

These funds lend money (either directly or through real estate-backed notes) and earn interest income. They offer more predictable returns and often sit higher in the capital stack than equity, meaning lower risk but also lower upside.

4. Real Estate Syndications

In a syndication, multiple investors pool capital to acquire a specific real estate asset. One sponsor (or General Partner) manages the deal, while passive investors (Limited Partners) receive a share of profits. Capital is usually tied to a single deal.

5. Fund of Funds (FoF)

A Fund of Funds aggregates capital to invest in multiple underlying real estate syndications or private funds. This offers instant diversification across assets, markets, and operators, which helps reduce risk for investors while maintaining upside.

6. Hedge Funds

These are pooled investment vehicles that use a range of strategies (including long/short, arbitrage, and derivatives) to generate returns. They’re highly flexible but often complex and more volatile.

7. REITs (Real Estate Investment Trusts)

Public or private, REITs invest in income-producing real estate and are structured to pay out most of their income as dividends. Public REITs offer liquidity but are more correlated with stock market performance.

8. Interval Funds

These funds offer periodic liquidity (e.g., quarterly redemptions) while investing in private real estate, debt, or other alternative assets. They’re a hybrid between liquid and private funds, appealing to investors wanting more flexibility.

9. GoFundMe & Crowdfunding Platforms

Crowdfunding platforms like GoFundMe, Kickstarter, and Indiegogo allow individuals or groups to raise capital from many small contributors. Unlike traditional funds, these are donation-based or reward-based and often used for personal causes, creative projects, or product launches.

10. Mutual Funds

Mutual funds pool money from multiple investors to purchase a diversified portfolio of stocks, bonds, or other assets. Managed by professionals, they’re ideal for passive investors seeking diversification and steady returns.

11. Exchange-Traded Funds (ETFs)

ETFs are similar to mutual funds but trade on stock exchanges like individual stocks. They offer liquidity, low fees, and diversification, making them a popular choice for both passive and active investors.

12. Index Funds

Index funds track a specific market index, like the S&P 500. They offer broad market exposure, low operating costs, and consistent returns over time, making them ideal for long-term, hands-off investors.

13. Pension Funds

Pension funds manage retirement savings for employees, typically contributed by both employees and employers. These funds focus on generating stable, long-term returns to meet future obligations.

14. Sovereign Wealth Funds (SWFs)

SWFs are state-owned investment funds used by governments to manage surplus reserves, often from natural resources like oil. They invest globally in stocks, bonds, infrastructure, and alternative assets.

15. Family Offices

Family offices manage the wealth of high-net-worth families, investing across multiple asset classes, including private equity, real estate, and hedge funds. They often have highly customized investment strategies.

16. Infrastructure Funds

These funds invest in large-scale infrastructure projects like airports, highways, energy plants, and utilities. They’re typically backed by long-term contracts and offer stable returns but require significant capital.

17. Commodity Funds

Commodity funds invest in physical goods like gold, oil, or agricultural products, or in commodity futures. They’re often used to hedge against inflation and diversify investment portfolios.

18. Impact & ESG Funds

Environmental, Social, and Governance (ESG) funds prioritize sustainability and ethical considerations alongside returns. Impact funds specifically target projects that drive positive social or environmental change.

19. Accelerator & Incubator Funds

Accelerator and incubator funds invest in very early-stage startups, often providing mentorship, resources, and networking in addition to capital. Returns are highly speculative but potentially significant.

20. Special Purpose Acquisition Companies (SPACs)

SPACs are shell companies created to raise funds via an IPO and later acquire or merge with a private company. They’ve grown in popularity as an alternative way to take companies public.

21. Microfinance Funds

Microfinance funds provide small loans to entrepreneurs and low-income individuals in developing countries. They aim to promote financial inclusion while generating modest, stable returns.

22. Charitable & Endowment Funds

These funds manage donations for universities, nonprofits, and foundations. They invest contributions to generate income while preserving principal, funding long-term missions and programs.

23. Hybrid Funds

Hybrid funds combine multiple asset classes—such as stocks, bonds, and alternatives—within a single portfolio. They’re designed to balance growth potential and risk management.

24. Interval Real Estate Investment Funds

A specialized form of interval funds, these invest solely in real estate and allow periodic redemptions, offering investors access to illiquid markets without fully locking up their capital.

25. Litigation Finance Funds

Litigation funds provide capital to plaintiffs or law firms to finance lawsuits in exchange for a portion of any settlement or award. Returns can be high but depend heavily on legal outcomes.

Legal

Business Continuity Plan

Privacy Policy

Private Placement

Legal Notice

Terms Of Use

General Disclosure

About

Contact

Investing involves risk, including loss of principal. Past performance does not guarantee or indicate future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. While the data we use from third parties is believed to be reliable, we cannot ensure the accuracy or completeness of the data provided by investors or other third parties.

Neither Zenya Capital Investments nor any of its affiliates provides tax advice and does not represent in any manner that the outcomes described herein will result in any particular tax consequence. Offers to sell, or solicitations of offers to buy, any security can only be made through official offering documents that contain important information about investment objectives, risks, fees, and expenses. Prospective investors should consult with a tax or legal adviser before making any investment decision.

Different rules apply to accredited investors and non-natural persons. Before making any representation that your investment does not exceed applicable thresholds, we encourage you to review Rule 251(d)(2)(i)(C) of Regulation A. For general information on investing, we encourage you to refer to www.investor.gov.

Bobby Zapp Founder/CEO

Invest@zenyacapital.com

+1 609 248 5375

405 Magnolia Road

Pemberton, N. J. 08068

All Rights Reserved © 2022/2026 Zenya Capital

A Subsidiary of... A. McChild Business Systems and

Zaniru Enterprises Inc. All Rights Reserved

Zenya Capital is not a registered investment advisor

Therefore, does not provide investment advice.

Website By BuzyBeeWebdesign.com